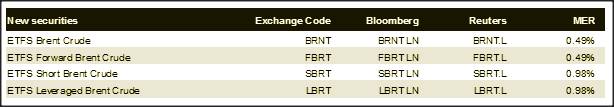

ETF Securities has listed four new exchange-traded commodity (ETC) products on the London Stock Exchange, in recognition of Brent Crude’s growing importance as the new global benchmark for oil. The new products provide investors with long, leveraged, short and forward exposures to Brent Crude and add to the issuer’s existing range of 1-month, 1-year, 2-year and 3-year exposure products.

ETF Securities has expanded its Brent crude ETC range as Brent gains in status and geopolitical tensions rise.

Brent crude is increasingly seen as the global benchmark for crude oil, particularly as West Texas Intermediate has been beset with local logistical issues that have seen it move to a significant discount to Brent.

During its annual investment conference held earlier this year, ETF Securities asked delegates in to consider how various scenarios might impact their asset allocation decisions. Three quarters of respondents to the poll said they expected tensions in the Middle East to escalate and two thirds believed this would occur within the first half of the year.

Perhaps unsurprisingly, the vast majority of respondents said this would have an impact on their asset allocation decisions.

The past two months has seen a dramatic increase in tensions in the important oil region of the Gulf, primarily as Iran has reacted to the new US and EU sanctions aimed at curbing its oil exports in response to the alleged military dimension of the country’s nuclear programme. Brent Crude has risen 13% year to date, as a consequence.

The increased importance of Brent Crude as a global benchmark was also reflected in the 2012 annual rebalancing of the Dow-Jones UBS Commodity Index; Brent Crude now accounts for a third of the index’s oil weighting.

Commenting, Neil Jamieson, Head of UK Sales, ETF Securities, said: “The launch of these new Brent exposures is timely. Brent has emerged as the reference benchmark for crude oil and is therefore potentially sensitive to developments that could impact international oil supplies. Our recent poll shows that investors are understandably concerned about how to position themselves in light of the continued unrest in the Middle East.

“ETF Securities provides investors with a comprehensive range of solutions to take exposure to crude oil and the energy complex more generally. These now include the ability to take inverse exposure to the movement of the underlying Brent index.”

The new ETFS Brent Crude oil ETCs offer classic, forward, short and leveraged exposures to Brent Crude and are issued by ETFS Commodity Securities Ltd, a Jersey-based special purpose vehicle designed to provide investors with a wide variety of total return commodity investment strategies.

New Brent Crude oil ETCs track the performance of the Brent Crude sub-indices of the Dow Jones-UBS Commodity Index via fully funded collateralised swaps.

Exposure to Brent Crude is obtained via multiple swap counterparties: UBS AG, London branch and Bank of America Merrill Lynch acting through Merrill Lynch Commodities Inc.

It is intended that the new products will also be listed on Deutsche Börse in the near future.