By Antoine Lesne, head of SPDR ETF sales strategy EMEA, State Street Global Advisors

Antoine Lesne, head of SPDR ETF sales strategy EMEA at State Street Global Advisors.

As generally expected, last week’s European Central Bank (ECB) meeting unfolded without any surprises; nothing new under the sun, so let’s enjoy it while the summer is here and continue to consider Euro corporate bonds. Such a cool, calm attitude suits the need to analyse the consequences of Brexit on the Eurozone. Mario Draghi also had a message that the Central Bank’s actions are but one tool in a whole kit of tools available to support growth and employment; other policy areas need to act swiftly, too.

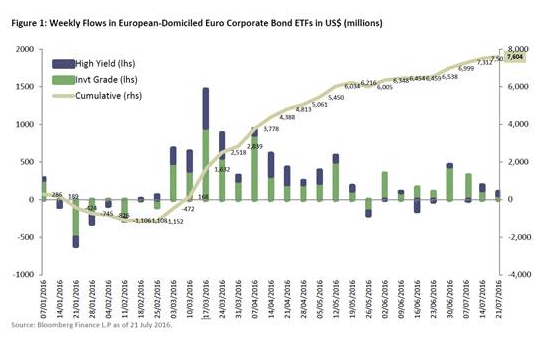

Much of the focus coming into the meeting centred around the potential scarcity of bonds to buy since the Corporate Sector Purchase Programme (CSPP) was increased from €60bn to €80bn per month and extended in time to March 2017 and in scope to include corporate bonds. This scarcity may be solved with more corporate bond buying. While no options have been discussed at this stage, we take a look at the Euro corporate bond market, which has been the second-best asset-gathering sector in the European ETP market year to date with $7.6bn of inflows (almost 24% of total net flows).

What Are European Investors Doing? Still Chasing Yield…

What Are European Investors Doing? Still Chasing Yield…

As discussed many times this year, the announcements and actions of the ECB have led to significant inflows in Euro corporate bond ETFs domiciled in Europe. Year-to-date net inflows amounted to circa $7.6bn. Investment grade corporate bond funds were strong beneficiaries, with $5.7bn of inflows, or 75% of the total assets gathered in this universe. The universe of Euro corporate, covered bonds and high yield bonds ETFs is worth circa $41.5bn.2 Figure 1 shows the strength of cumulative flows and in particular the significant inflows of $1.5bn in the week following the 10 March ECB meeting.

Why Are Investors Favouring Corporate Bonds? Three Key Reasons

First, the economic cycle is not dead. Granted, forecast Eurozone growth for 2017 has been downgraded by the IMF this week from 1.6% to 1.4% as a consequence of Brexit, but the impact is not expected to be large enough to tip the Eurozone economy into recession and turn the credit cycle yet.

Second, the ECB is expected to continue to run accommodative policies that should further distort government bond prices and push yields into ever more negative territory, which could continue to push investors into corporate bonds. The challenge of generating inflation remains and expectations are currently anchored at low levels despite an expected pick-up in M3 monetary aggregates.

Third, and most important, the market has a new friend: the ECB! Purchases of corporate bonds by the CSPP have been relatively broad already; in the first eight weeks of the programme, circa €10.4bn of corporate bonds across around 450 different issues were bought.

Based on the recent estimates and buying patterns, the ECB is expected to buy around 10% of the €700bn3 of bonds currently meeting the eligibility criteria (namely Euro-denominated bonds from Eurozone established issuers, which are ranked as investment grade by at least one rating agency, with no subordinated debt, from six months to 31 years to maturity, and with a yield to maturity above the deposit facility rate). This equates to a potential €60bn-€70bn of additional demand for investment grade corporate debt in the market over the next few quarters. Meanwhile, corporate bond issuance year to date has been around €103bn, according to Dealogic, but the net issuance for the remainder of the year is forecast to be negative: -€30bn for financials and a mere +€3bn for non financials. Consequently, this new buyer brings with it the potential to keep spreads relatively well behaved.

Corporate Bond vs. Government Bond Yields : The Pick-Up

The seemingly unabated thirst for yield looks set to become a secular trend. In a lower-for-longer environment, investors continue to require additional yield over those offered by Eurozone core countries sovereign bonds. Central banks’ actions, and those of the ECB in particular, continue to push investors to look for yield across spread exposures, from investment grade to high yield. Depending on whether investors look to extend interest rate risk to capture higher yield or prefer to keep duration in check, different types of indices are worth the investigation, in particular intermediate and long maturity indices. Staying close to the ECB and its purchase programme has allowed investors to weather the turmoil this year. Being nimble by allocating throughout the curve can be a strategy worth examining, too. For a View on the Curve, Look at Maturity Buckets

For a View on the Curve, Look at Maturity Buckets

We highlight the main characteristics of three corporate bond indices in the table below:

Given that the ECB is not buying bank debt, sector weighting may be an important consideration for investors; see Figure 4 for the breakdown by index. The table shows that the long end of the Euro corporate curve has a lower weight in banking than the broader index (at 19.9% vs. 32.4%). There exists a potential for further spread tightening should the ECB purchases continue at their current pace.

(The views expressed here are those of the author and do not necessarily reflect those of ETF Strategy.)